New report ranks Illinois as least ‘tax-friendly’ state

By Jim Moran

Illinois is the “least tax-friendly” state in the nation, according to a new report from business and economic forecasting publisher Kiplinger.

The state’s economic woes and property taxes were major factors in the ranking.

Kiplinger Tax Editor Rocky Mengle said the rankings were compiled by using the tax burden of a “hypothetical middle-class family” in all 50 states and Washington D.C.

The study found that the income tax in Illinois was in the middle of the pack nationally. Mengle called it “average” compared to other states. However, he said that when combined with all other taxes, Illinois residents pay much more to the government than residents of other states. Property taxes were the biggest factor. According to the study, Illinois had the second-highest property taxes in the nation, behind only New Jersey.

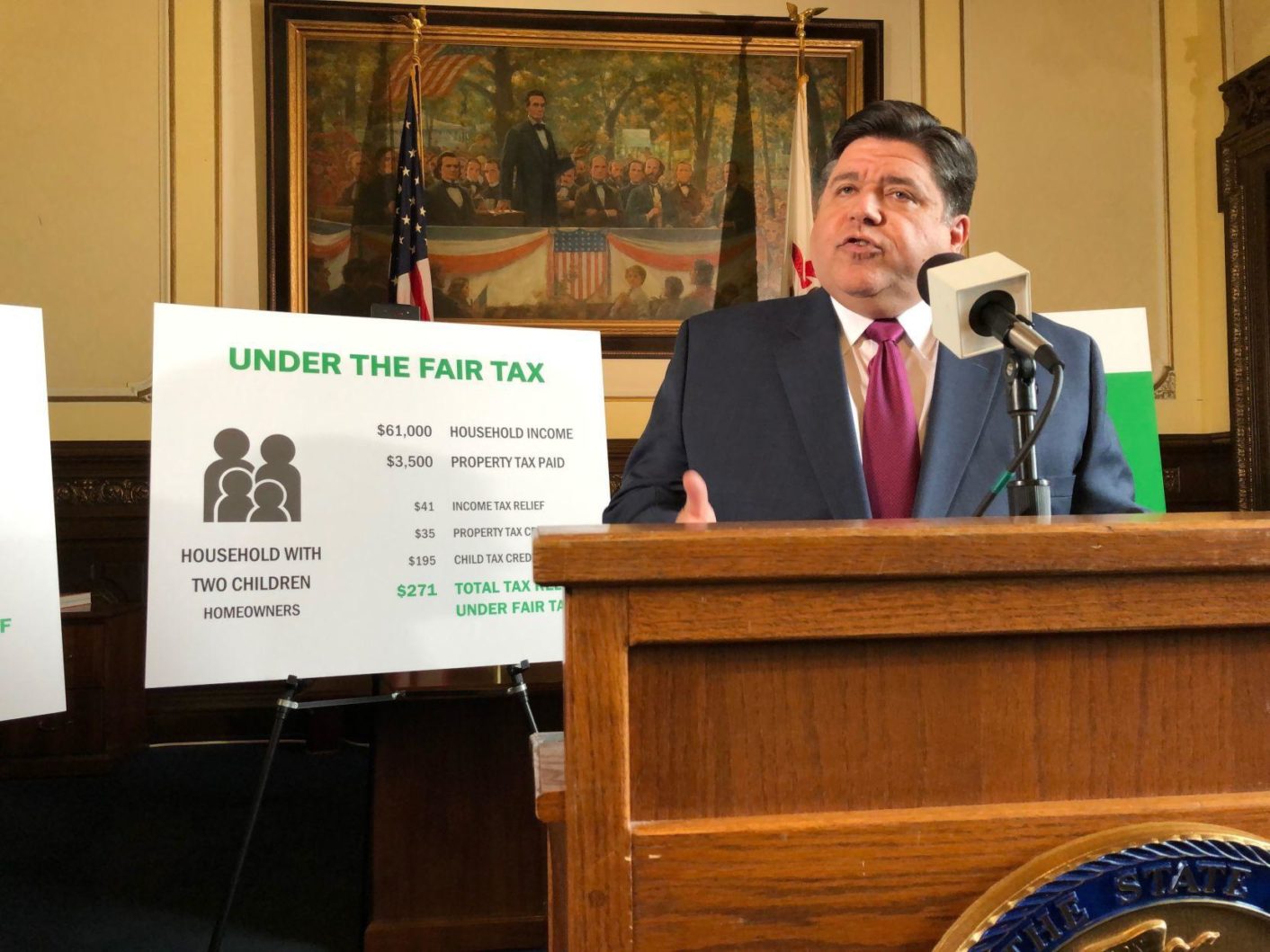

Gov. J.B. Pritzker and Democratic lawmakers are urging voters to support a constitutional amendment to change the state’s existing flat 4.95 percent income tax to a progressive structure with higher rates for higher earners. If approved by voters on the November 2020 ballot, lawmakers have passed proposed income rates that would raise income tax collections by more than $3 billion a year. Under that plan, most taxpayers would pay slightly less in income taxes, but those earning more than $250,000 would pay at least 7.75 percent.

Other taxes hit Illinois residents harder than most other states. Mengle said Illinois’ sales tax was another factor in the ranking. The sales tax in Illinois ranked as the seventh highest in the nation. According to the report, the average combined state and local sales tax in Illinois was 8.78 percent. Mengle said that in some Illinois cities, municipal taxes push the sales tax rate higher than 10 percent. While most states exempt food and drugs from sales tax, Illinois does not.

Gasoline taxes in Illinois were ranked the third highest in the country. Illinois also has the highest average state and local tax on wireless cellphone service at 20.91 percent. Illinois’s estate tax on estates over $4 million was one of the few such taxes left in the nation.

Despite having lower income taxes, Wisconsin was ranked fourth overall on the least tax-friendly list. Mengle said high property taxes in Wisconsin was a factor. Wisconsin had the sixth-highest property taxes in the nation and had income taxes rated as above average.

Iowa ranked ninth in the overall list of least tax-friendly states. Mengle said like Illinois and Wisconsin, high property taxes were a problem for Iowa. It also ranked 12th on the list of highest property taxes in the nation.

Illinois’ overall tax burden could make it more difficult for the state to attract new residents, Mengle said.

The state’s population has declined for five consecutive years.